Oregon Withholding Tax Formulas 2025. Use this form to determine how much tax is due for domestic employees for state income tax withholding, unemployment insurance, paid leave oregon, and workers’ benefit. 22 published withholding tax tables for different payroll periods, for corporate income and individual income tax.

Oregon personal income tax resources including tax rates and tables, tax calculator, and common questions and answers. The standard deduction used in the withholding formulas increased to.

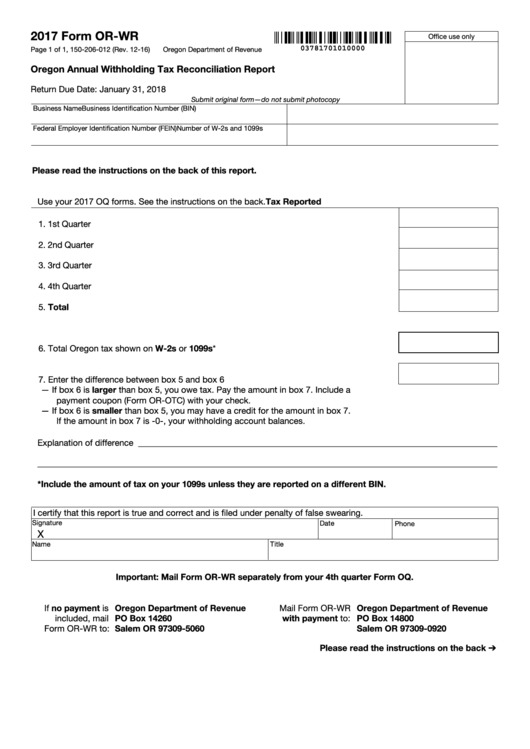

Oregon Employee Withholding Form 2025, The oregon department of revenue (dor) dec. 2025 personal income tax calculator.

Oregon State Withholding Tax Fill Out, Sign Online and Download PDF Templateroller, The standard deduction amount for single filers claiming less than. Oregon state income tax tables in 2025.

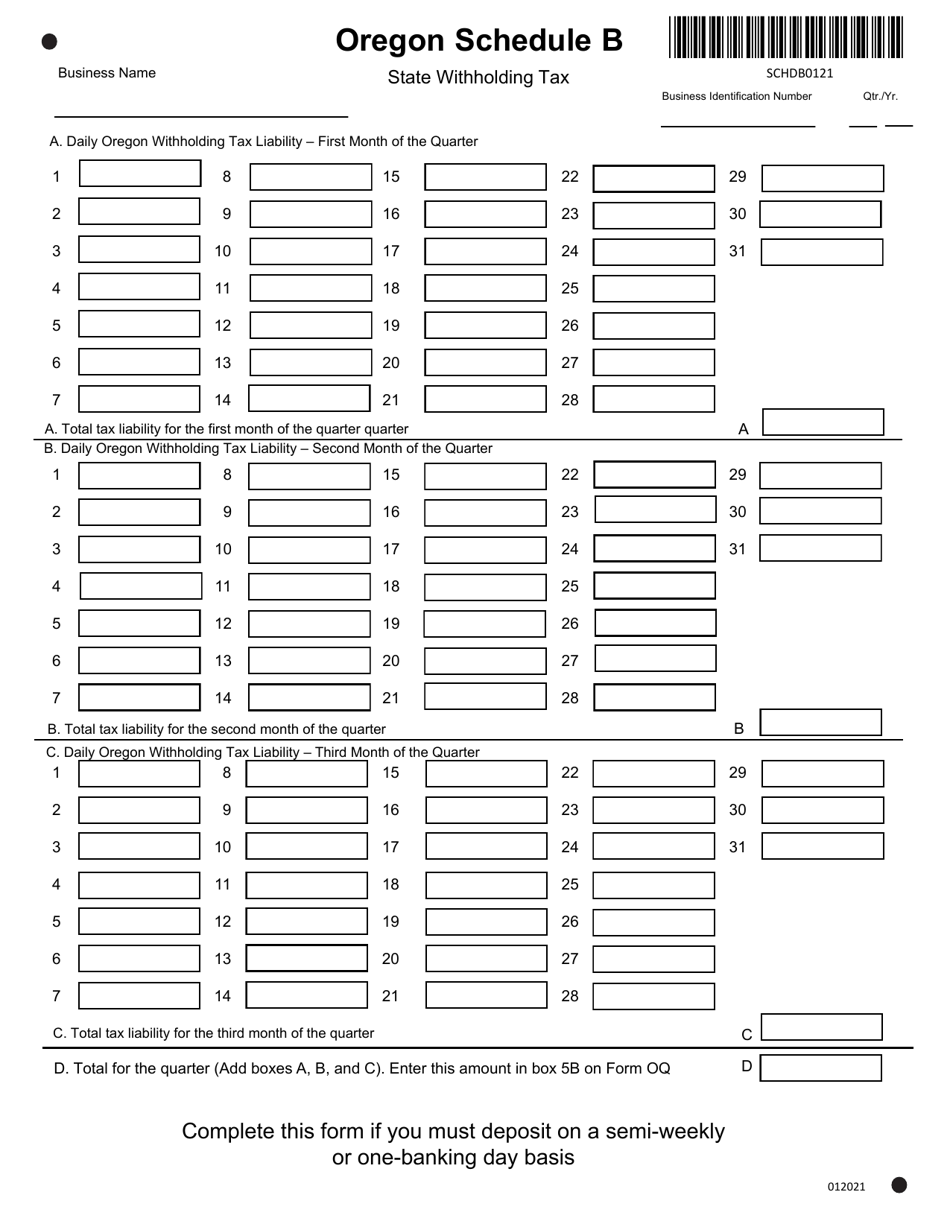

Oregon Schedule B State Withholding Tax printable pdf download, 22 issued guidance on withholding tax formulas, effective jan. Use our income tax calculator to find out what your take home pay will be in oregon for the tax year.

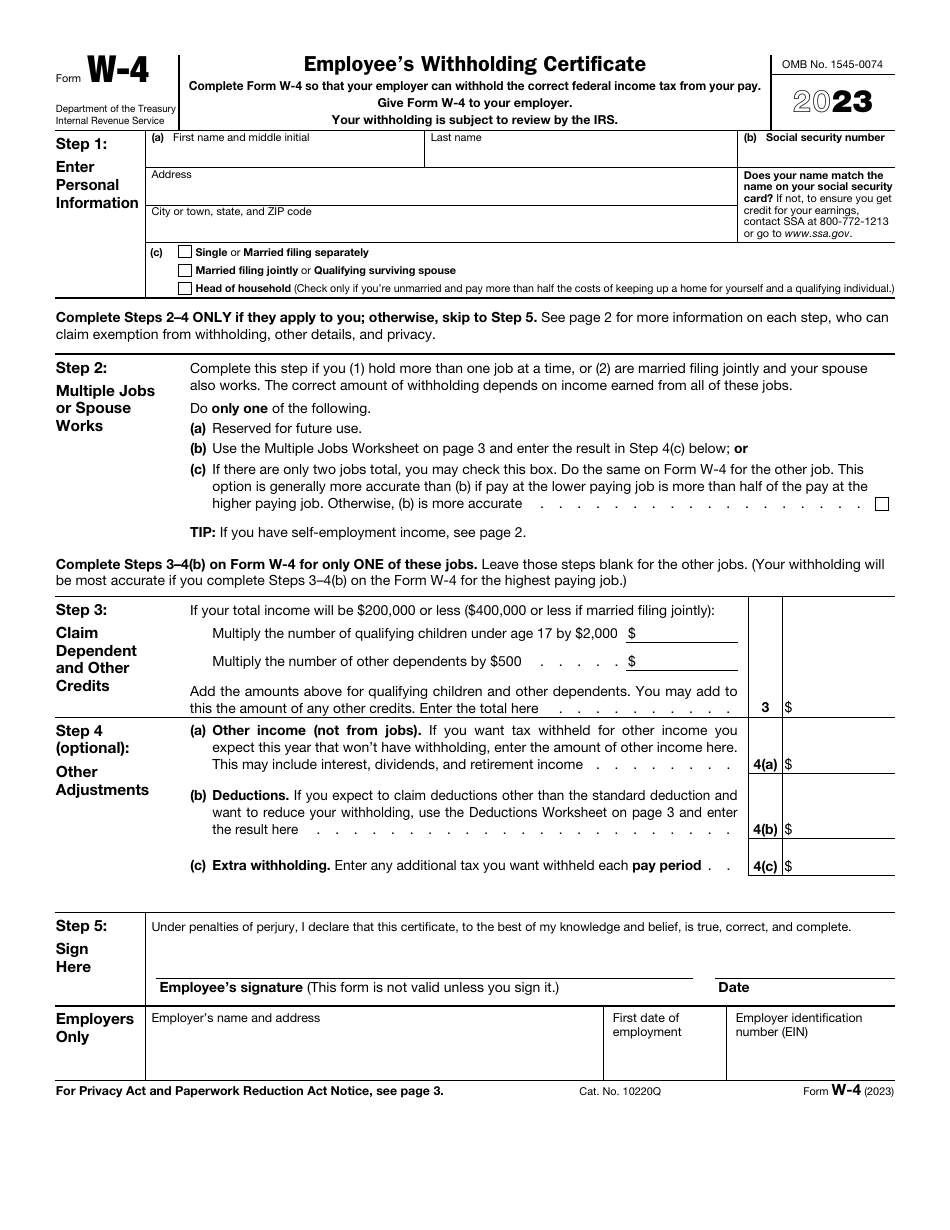

Oregon W 4 Allowances, Overview of withholding and payroll formulas, rates and deductions. Oregon’s 2025 withholding formula was released by the state revenue department.

Irs Monthly Withholding Tables 2025 agnola shanta, Find your pretax deductions, including 401k, flexible account contributions. Use our income tax calculator to find out what your take home pay will be in oregon for the tax year.

Federal Withholding Tax Table Matttroy, The oregon department of revenue (dor) dec. Our withholding calculator will help you get the correct amount of tax withheld.

Irs W 4 Calculator 2025 Dedie Eulalie, The oregon department of revenue dec. The standard deduction amount for single filers claiming less than.

Oregon Tax Brackets For 2025 Cindra Ronalda, Calculate your annual salary after tax using the online oregon tax calculator, updated with the 2025 income tax rates in oregon. The income tax withholding formula for the state of oregon includes the following changes:

oregon tax tables, Calculate your annual salary after tax using the online oregon tax calculator, updated with the 2025 income tax rates in oregon. 22 issued guidance on withholding tax formulas, effective jan.

Irs Payroll Withholding Tables 2025 Kipp Simone, Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of revenue. The income tax rates and personal allowances in oregon are updated annually with new tax tables published for resident and non.